- This event has passed.

Property Tax 2023 Deadline

October 31, 2023 @ 8:30 am - 4:30 pm

Property Tax Bill Information

- The 2023 property tax statements have now been mailed out. They are due on October 31, 2023.

- Penalties on outstanding arrears are calculated at 1.25% on the 1st of each month.

- Tax statements are sent to the mailing address that the RM has on file. If you have not received your statement by the second week of September, please contact the RM office to request a copy.

- Tax receipts are only issued if there is a balance remaining or if they are requested. Please contact the RM office to request a copy.

- If you are on the PAP plan, you will still receive a tax statement. The balance will show payment to July 15 when printed, your account will continue to be credited as payments are received.

Property Tax Payment Options

We encourage the use of remote payment options such as:

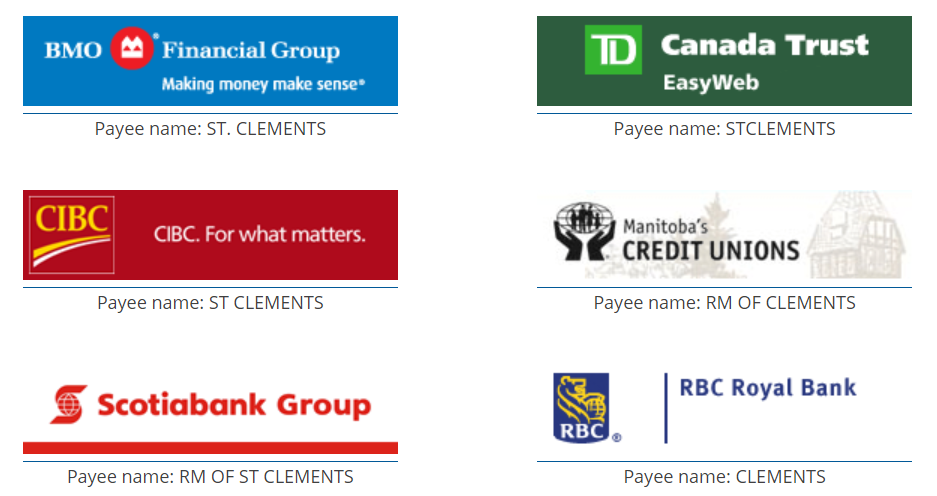

1. Online: use ‘RM of St Clements (taxes)’ as a bill payee through your financial institutions bill payment option. Use your roll number (top right corner of bill) as your account number by: dropping any zeros at the start of the number, removing the decimal and adding zeros at the end to make it either 6 or 9 digits depending on your bank.

NOTE: online bill payments can take up to 5 business days to reach our office, please take this into consideration and pay with ample time before the due date

2. Mail: cheques can be made payable to the ‘RM of St. Clements’ and mailed to Box 2 Grp 35 RR 1, East Selkirk MB, R0E 0M0.

NOTE: include your roll number on the cheque and ensure that envelope is post marked before the due date. Post-dated cheques for October 31, 2023 are welcome.

3. Mail Slot at Office: cheques following the same format as above can be placed in an envelope and left in our secured mail slot located at the back (south) of our building. Mail slot is available for use after hours, including evenings and weekends. Park in the south parking lot, go up the stairs/ramp and you’ll find the slot located in the door.

4. Pre-Authorized Payment Program: sign up to make monthly payments by completing the enrollment form and submitting along with a void cheque. Please contact us for the form or find it here.

5. In Person at the RM Office: Our office is located at 1043 Kittson Road in East Selkirk. Here we accept cash, cheque and debit (check with your financial institution prior to ensure your point of purchase limit is high enough for the amount you are paying).

NOTE: We do not currently accept credit cards.

6. Drive-Thru Tax Option: For minimal contact and to avoid waiting in a line at the office, we encourage you to make payment by visiting us in our Tax Drive-Thru starting October 23, 2023.

Simply have your cheque filled out with your roll number or bottom portion of the tax bill and pull through to the RV Trailer in the parking lot at 1043 Kittson Road, we will have one-way drive thru access off of Quarry Road, just follow the signage. Cheques can be post-dated for October 31, 2023.