The Province is introducing the Education Property Tax Rebate for their 2021 Budget which includes Manitoba phasing out education property taxes by implementing the Education Property Tax Rebate.

What you need to know

Property owners will receive an Education Property Tax Rebate cheque to reduce a portion of their education property taxes. No application is required and property owners will receive their Education Property Tax Rebate cheque in the mail the month their municipal property taxes are due.

Depending on the municipality, owners of multiple properties may receive one combined rebate cheque.

How the rebate works

Residential and farm properties

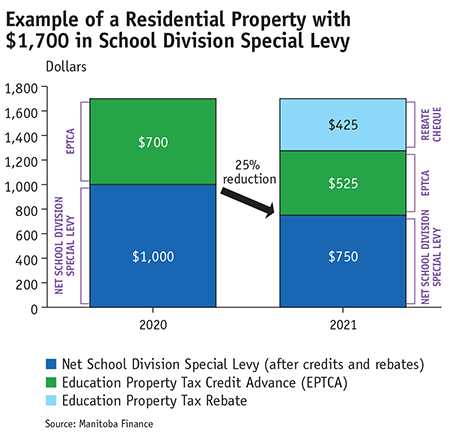

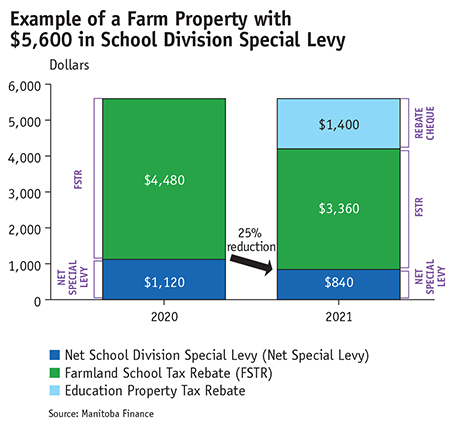

For 2021, owners of residential and farm properties will receive a 25 per cent rebate of the school division special levy payable, which will increase to 50 per cent in 2022. Residential properties include single dwelling units, condos and multiple unit dwellings. The average rebate will be an estimated $1,140 per property for 2021 and 2022.

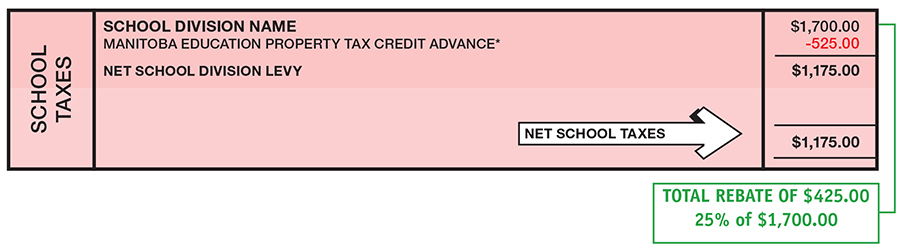

The Education Property Tax Rebate will be based on the school division special levy before the Education Property Tax Credit Advance.

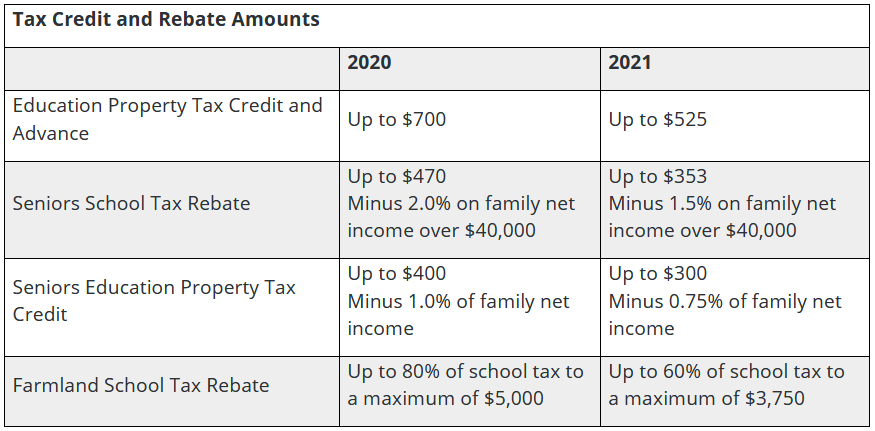

As part of the Education Property Tax Rebate, other tax credits and rebates will be proportionally reduced as follows:

Note: Farm property owners must still apply for the Farmland School Tax Rebate.

The examples below demonstrate that residential and farm property owners will be paying 25 per cent less in education property taxes as illustrated below:

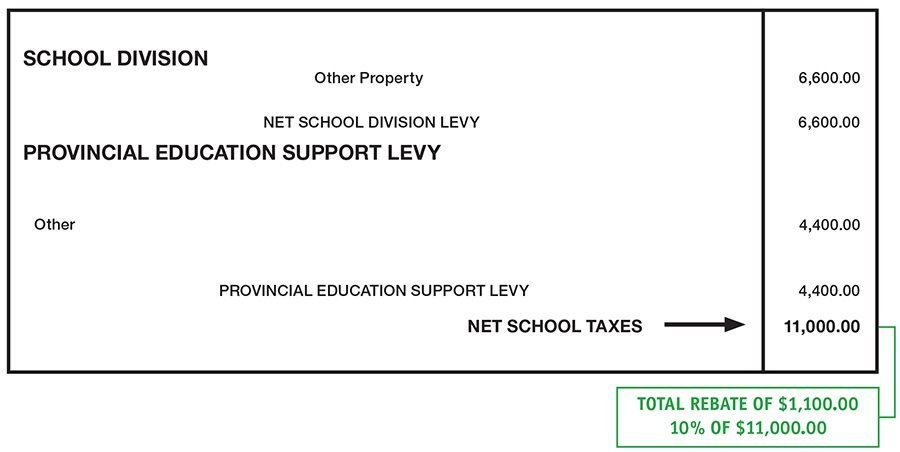

Other properties

Owners of other properties (such as commercial, industrial, railway, institutional, pipelines and designated recreational) will receive a 10% rebate of the total of both the school division special levy and the education support levy payable.

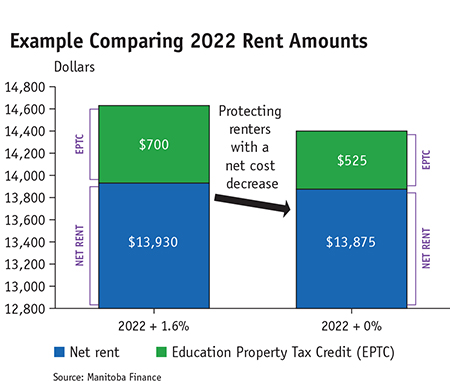

Renters

To account for the fact that landlords of residential buildings and not renters will be receiving the Education Property Tax Rebate, the annual rent guidelines will be set at 0% for 2022 and 2023.

Using a 1.6 per cent increase for comparision purposes, monthly rent of $1,200 would remain at $14,400 annually in 2022 versus $14,630.

The example below demonstrates the savings for renters from setting rent guidelines to 0% will offset the reduction in the education property tax credit and protect renters:

Education property tax rebate calculator

An education property tax rebate calculator is now available online so property owners can calculate their 2021 rebate once they have received their 2021 property tax statement.

Frequently asked questions

Click here to view the Education Property Tax Rebate FAQ

For more information

Please contact Manitoba Government Inquiry for more information:

1-866-MANITOBA (1-866-626-4862)

This information has been provided from the Province of Manitoba, click here to go to their web page.